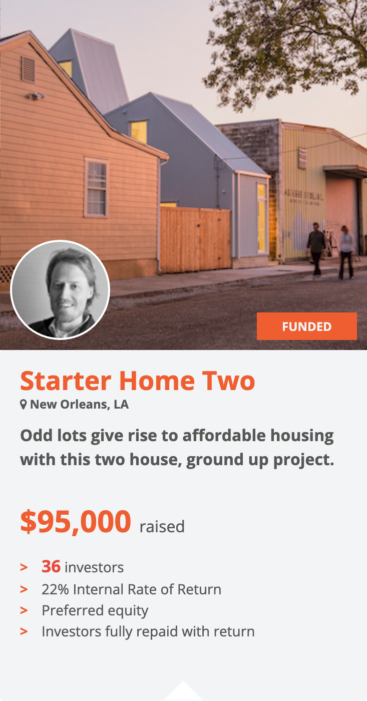

Impact Investment Opportunities

read the articles

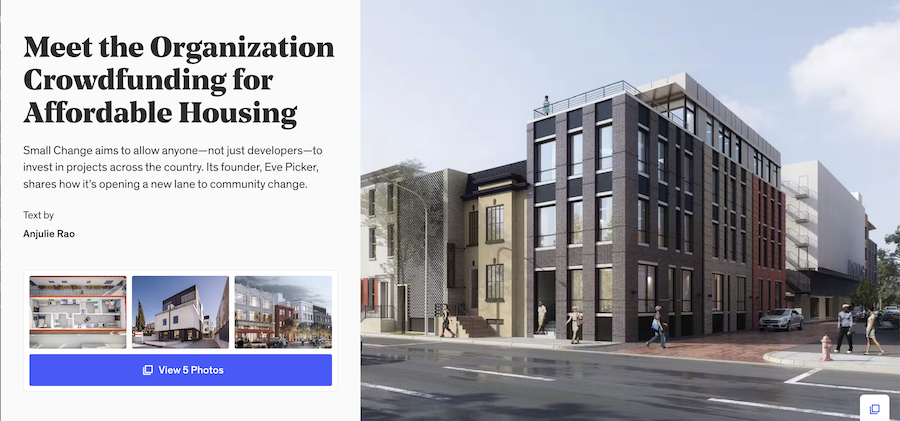

Big change for Small Change.

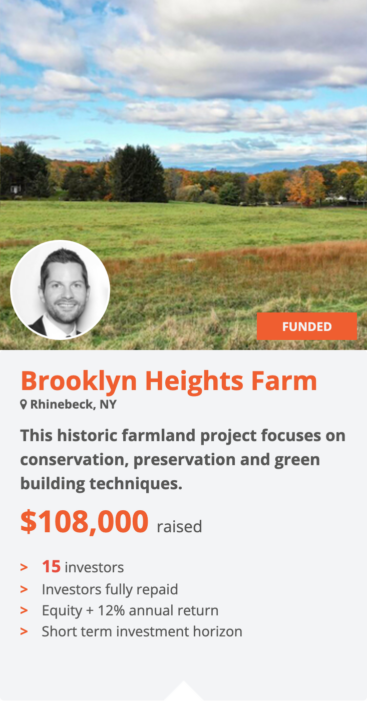

SmallChange.co Expands, Welcomes Five Partners With Expertise in Regulation Crowdfunding PITTSBURGH – March 6, 2024 – SmallChange.co, an investment crowdfunding platform focused on real estate development with social impact, has expanded…

El Centro Home.

Revitalization. Repurposing a vacant property into a school designed to enhance learning Minority project partner. Latino-owned firm providing development support Workforce training. A path to success for students disengaged from high…

Office conversion.

According to CBRE the overall U.S. office vacancy rate hit a 30-year-high of 18.2% in mid-2023 That doesn’t sound so bad, but reality is just not so even-handed. Only 10% of…